Commercial name. Is it possible to give an individual entrepreneur a name other than his full name?

Today, more and more people are engaged in entrepreneurship. On the territory of the Russian Federation, becoming an individual entrepreneur is becoming easier and easier. To legalize his activities, an individual entrepreneur is obliged. Is it possible to give the IP a name? This question puzzles many entrepreneurs, since regulations do not provide specific guidance on this matter.

PR stunt or official name

Today the following are required to have an official name:

- legal entities;

- individuals registered as individual entrepreneurs.

Can an individual entrepreneur have a company name? This question is quite difficult to answer, since the question immediately follows - what name? The fact is that according to the law, an individual entrepreneur or a legal entity carrying out economic activities can have two names:

- official;

- commercial.

The first is indicated in the constituent documents and certificates with OGRNIP numbers, and the second is used to a greater extent for advertising. It follows from this that business companies and private businesses have the right to assign themselves an official and commercial designation.

Can an individual entrepreneur have a name that differs from its official data and is not contained in its constituent documents? Maybe. For these purposes, the concept of “commercial designation” appeared. In fact, the owner’s full name will not particularly attract a large number of customers who are accustomed to paying attention to bright and “loud” signs.

How to assign a name to an individual entrepreneur?

This question can be fully answered by Article 1538 of the Civil Code of Russia, which says:

- all commercial and non-profit organizations and individual entrepreneurs have the right to improve their financial condition to have two names: official and commercial (additional);

- legal entities or individuals do not have the right to use several commercial designations for one business unit.

Thus, the unofficial name is not recorded anywhere. However, before giving a name to an individual entrepreneur, think carefully again about whether it is worth doing.

Creating your own logo or trademark will help you finally legitimize a beautiful name for an individual entrepreneur. Remember that these attributes of entrepreneurial activity must be officially recorded in your constituent documents. Printing in this case is simply inevitable. The imprint of this business “accessory” must contain the full name of the individual entrepreneur, the place of his business activity, the Taxpayer Identification Number (TIN), and the logo. For more detailed information, an individual entrepreneur who does not want to engage in business under his own name should refer to 129-FZ.

Individual entrepreneur (IP)(obsolete private entrepreneur (PE), PBOYUL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact possessing many of the rights of legal entities. The rules of the civil code regulating the activities of legal entities apply to individual entrepreneurs, except in cases where separate articles of laws or legal acts are prescribed for entrepreneurs.()

Due to some legal restrictions (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

In case of gross violations or when working without a license - up to 8,000 rubles. And, it is possible to suspend activities for up to 90 days.

From RUB 0.9 million for three years, and the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles.

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 198, paragraph 3 of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Article 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles. for three years, and the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles.

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of taxes (fees)

1. Non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction) entails a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for in paragraph 1 of this article, committed intentionally, entail a fine in the amount of 40 percent of the unpaid amount of tax (fee). (Article 122 of the Tax Code)

Penalty

If you were just late in payment (but did not provide false information), then there will be penalties.

The penalties for everyone are the same (1/300 multiplied by the key rate of the Central Bank per day of the amount of non-payment) and now amount to about 10% per annum (which is not very much in my opinion, taking into account the fact that banks give loans for at least 17-20 %). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after receiving a license, or permissions. Licensed activities of individual entrepreneurs include: pharmaceutical, private investigation, transportation of goods and passengers by rail, sea, air, as well as others.

An individual entrepreneur cannot engage in closed types of activities. These types of activities include the development and/or sale of military products, trafficking in narcotic drugs, poisons, etc. Since 2006, the production and sale of alcoholic beverages has also been prohibited. An individual entrepreneur cannot engage in: production of alcohol, wholesale and retail trade in alcohol (with the exception of beer and beer-containing products); insurance (i.e. be an insurer); activities of banks, investment funds, non-state pension funds and pawnshops; tour operator activities (travel agency is possible); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (sales possible) and some others.

Differences from legal entities

- The state fee for registering individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not require a charter and authorized capital, but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- Individual entrepreneurs do not have cash discipline and can manage the funds in the account as they wish. Also, the entrepreneur makes business decisions without recording them. This does not apply to working with cash registers and BSO.

- An individual entrepreneur registers a business only in his name, in contrast to legal entities, where registration of two or more founders is possible. Individual entrepreneurship cannot be sold or re-registered.

- A hired employee of an individual entrepreneur has fewer rights than a hired employee of an organization. And although the Labor Code equates organizations and entrepreneurs in almost all respects, there are still exceptions. For example, when an organization is liquidated, the mercenary is required to pay compensation. When closing an individual entrepreneur, such an obligation exists only if it is specified in the employment contract.

Appointment of director

It is legally impossible to appoint a director in an individual entrepreneur. The individual entrepreneur will always be the main manager. However, you can issue a power of attorney to conclude transactions (clause 1 of Article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, it has been legislatively established for individual entrepreneurs to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom certain powers are delegated directors. A large legislative framework on rights and responsibilities has been developed for directors of organizations. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the district tax office at the place of registration, in Moscow - MI Federal Tax Service of the Russian Federation No. 46 for Moscow.

Individual entrepreneurs can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from 16 years of age, with the consent of parents, guardians; married; a court or guardianship authority has made a decision on legal capacity)

- foreign citizens living in the Russian Federation

OKVED codes for individual entrepreneurs are the same as for legal entities

Necessary documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (1 copy). Sheet B of form P21001 must be filled out by the tax office and given to you.

- A copy of the Taxpayer Identification Number.

- A copy of your passport with registration on one page.

- Receipt for payment of the state fee for registration of an individual entrepreneur (800 rubles).

- Application for switching to the simplified tax system (If you need to switch).

An application for registration of individual entrepreneurs and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must be given the following documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from the Unified State Register of Individual Entrepreneurs (USRIP)

After registration

After registering an individual entrepreneur It is necessary to register with the pension fund and the Compulsory Medical Insurance Fund and obtain statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, and registering with Rospotrebnadzor.

Taxes

Individual entrepreneur pays a fixed payment to the pension fund for the year, 2019 - 36,238 rubles + 1% of income over 300,000 rubles, 2018 - 32,385 rubles + 1% of income over 300,000 rubles. The fixed contribution is paid regardless of income, even if the income is zero. To calculate the amount, use the IP fixed payment calculator. There are also KBK and calculation details.

An individual entrepreneur can apply tax schemes: simplified tax system (simplified), UTII (imputed tax) or PSN (patent). The first three are called special modes and are used in 90% of cases, because they are preferential and simpler. The transition to any regime occurs voluntarily, upon application; if you do not write applications, then OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (under OSNO). Another difference is that only entrepreneurs can use PSN. Also, individual entrepreneurs do not pay 13% on personal profits in the form of dividends.

An entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit financial statements (this only includes a balance sheet and a financial performance statement). This does not exclude the obligation to keep tax records: declarations of the simplified tax system, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Inexpensive programs for individual entrepreneurs include those with the ability to submit reports via the Internet. 500 rubles/month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult for an individual entrepreneur to get a loan from a bank than for a legal entity. Many banks also give mortgages with difficulty or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but profit is not allocated there. Patent and UTII are especially opaque in this matter; these systems do not even record income. The simplified tax system “Income” is also unclear, because it is not clear how many expenses there are. The simplified tax system "Income-Expenditures", Unified Agricultural Tax and OSNO most clearly reflect the real state of the individual entrepreneur's business (there is an accounting of income and expenses), but unfortunately these systems are used less frequently.

- The individual entrepreneur himself (as opposed to the organization) cannot act as collateral in the bank. After all, he is an individual. The property of an individual can be collateral, but this is legally more complicated than collateral from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, giving up everything, etc. And if in an organization you can change the director and founders with the click of a finger, then in this case an individual entrepreneur can just close it and terminate the loan agreement or go to court. IP cannot be re-registered.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing your plans to spend money. Personal loans usually have high rates, but not always. Especially if the client can provide collateral or has a salary card with this bank.

Subsidy and support

In our country, hundreds of foundations (state and not only) provide consultations, subsidies, and preferential loans for individual entrepreneurs. Different regions have different programs and help centers (you need to search). .

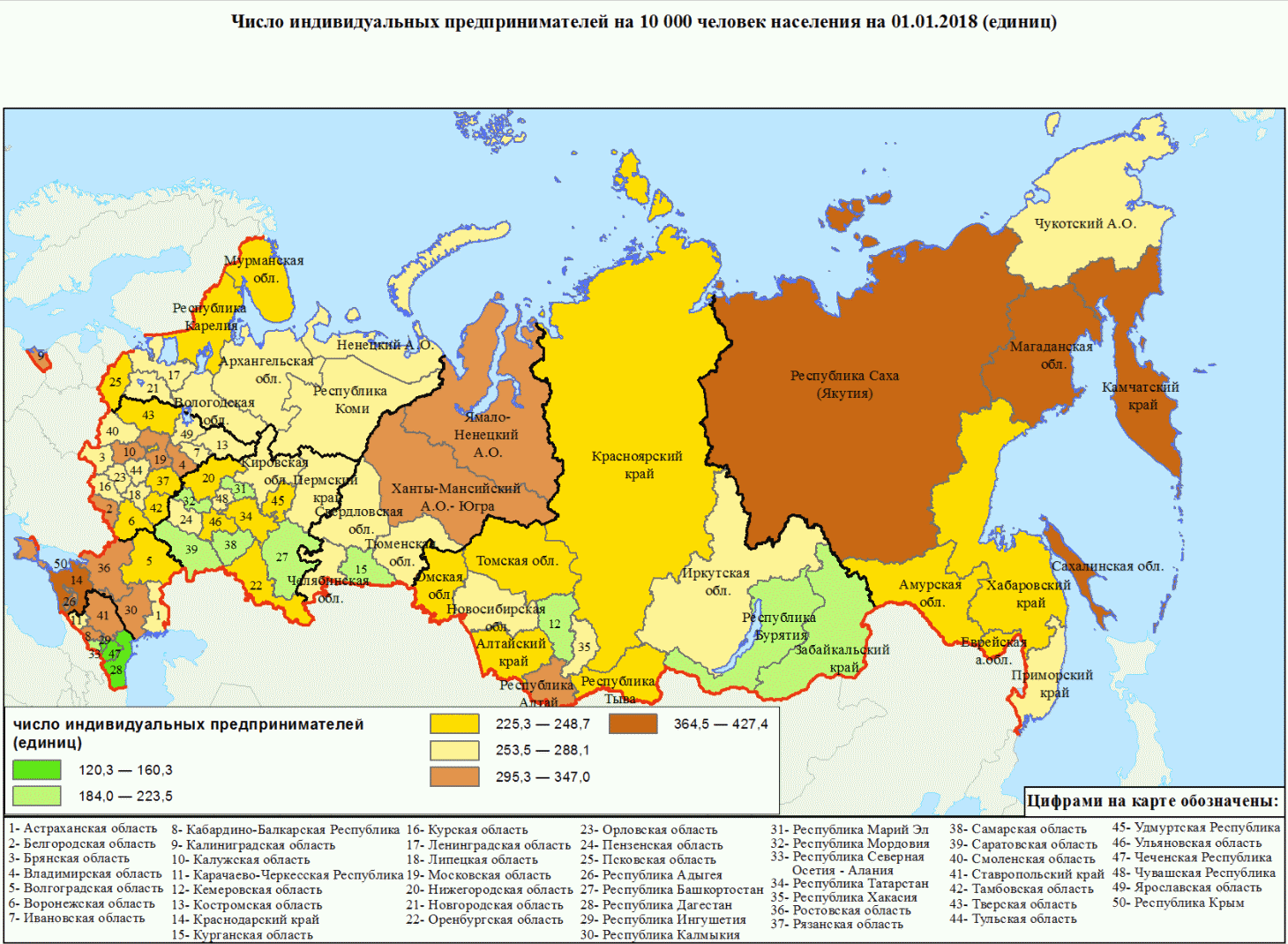

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Pension experience

If the entrepreneur pays everything regularly to the Pension Fund, then the pension period runs from the moment of state registration until the closure of the individual entrepreneur, regardless of income.

Pension

According to current legislation, an individual entrepreneur will receive a minimum pension, regardless of how many contributions to the Pension Fund he pays.

The country is undergoing almost continuous pension reform and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then his pension will not be indexed.

Insurance experience

The insurance period for the Social Insurance Fund only applies if the entrepreneur voluntarily pays contributions to the social insurance (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur himself. It is accepted only for hired workers. An individual entrepreneur, unlike a director, is not a mercenary.

Theoretically, an individual entrepreneur can hire himself, set a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because... then you will have to pay all salary taxes.

Only a female entrepreneur can receive maternity leave and only under the condition of voluntary social insurance. .

Any businessman, regardless of gender, can receive an allowance of up to one and a half. Either in RUSZN or in the FSS.

Individual entrepreneurs are not entitled to leave. Because he has no concept of working time or rest time and the production calendar also does not apply to him.

Sick leave is granted only to those who voluntarily insure themselves with the Social Insurance Fund. Calculated based on the minimum wage, the amount is insignificant, so in social insurance it makes sense only for mothers on maternity leave.

Closing

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

Closing an individual entrepreneur occurs in the following cases:

- in connection with the adoption of a decision by an individual entrepreneur to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court decision: forcibly

- in connection with the entry into force of a court verdict of deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of a document (overdue) confirming the right of this person to reside in Russia;

- in connection with a court decision to declare an individual entrepreneur insolvent (bankrupt).

Databases on all individual entrepreneurs

Website Contour.Focus

Partially free Contour.Focus The most convenient search. Just enter any number, last name, title. Only here you can find out OKPO and even accounting information. Some information is hidden.

Extract from the Unified State Register of Individual Entrepreneurs on the Federal Tax Service website

For free Federal Tax Service database Unified State Register of Individual Entrepreneurs (OGRNIP, OKVED, Pension Fund number, etc.). Search by: OGRNIP/TIN or full name and region of residence (patronymic name does not have to be entered).

Bailiffs Service

For free FSSP Find out about enforcement proceedings for debt collection, etc.

With help, you can keep tax records on the simplified tax system and UTII, generate payment slips, 4-FSS, Unified Settlement, SZV-M, submit any reports via the Internet, etc. (from 325 rubles/month). 30 days free. Upon first payment. For newly created individual entrepreneurs now (free).

Question answer

Is it possible to register using temporary registration?

Registration is carried out at the address of permanent residence. To what is indicated in the passport. But you can send documents by mail. According to the law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent registration in the passport (provided that it is more than six months old). You can conduct business in any city in the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in his employment record?

An entrepreneur is not considered an employee and does not make an entry in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude an employment contract with himself, make an entry in the work book and pay deductions as for an employee. This is unprofitable and makes no sense.

Can an individual entrepreneur have a name?

An entrepreneur can choose any name for free that does not directly conflict with the registered one - for example, Adidas, Sberbank, etc. The documents and the sign on the door should still have the full name of the individual entrepreneur. He can also register the name (register a trademark): this costs more than 30 thousand rubles.

Is it possible to work?

Can. Moreover, you don’t have to tell them at work that you have your own business. This does not affect taxes and fees in any way. Taxes and fees to the Pension Fund must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two individual entrepreneurs?

An individual entrepreneur is just the status of an individual. It is impossible to simultaneously become an individual entrepreneur twice (to obtain this status if you already have it). There is always one TIN.

What are the benefits?

There are no benefits in entrepreneurship for people with disabilities and other benefit categories.

Some commercial organizations also offer their own discounts and promotions. Online accounting Elba for newly created individual entrepreneurs is now free for the first year.

An individual entrepreneur has the right to open a bank account for conducting financial transactions, in addition, he can order the production of a seal for subsequent activities.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Is it necessary to register a sole proprietorship name? This issue always causes controversy, so it is important to consider it in detail.

Legislation

- Business entities may use commercial names. Such objects include a private entrepreneur. The commercial name is allowed not to be indicated in the unified state register or statutory documentation, in the opinion of the entrepreneur.

- Before using the chosen name, it is important to make sure that it does not conflict with moral and ethical values and norms.

- The name chosen by the entrepreneur can be used for other companies that belong to the individual entrepreneur. Only one name can be used for one structure.

Registration of a company name for an individual entrepreneur

Every established company must have an official name, and a private entrepreneur is no exception.

The name of the businessman will be indicated in the constituent documents. In addition, most entrepreneurs want to have a commercial name that reflects the specifics of the enterprise’s activities, is bright or attracts customers.

Is it required?

Often the signs of a company (office, enterprise, etc.) contain one name, but a completely different one is printed on the receipt. What explains this difference?

This is due to the fact that potential buyers are not attracted to the company name in the form of the last name, first name and patronymic of the manager.

That is why, in addition to the personal information contained in the documentation, you can come up with another name.

Is this required? No, having another name as an individual entrepreneur is not a prerequisite for a businessman to carry out activities.

He can use a different name that is not consonant with his full name, at his own request.

Options

There are many options for company names.

- attractiveness to potential clients;

- memorability, brightness;

- brevity and originality.

Some entrepreneurs pay special attention to developing the name of the establishment - they turn to specialized companies for help.

The latter not only come up with a suitable name, but also order the development of the story.

This attracts attention from buyers, which increases traffic or the number of orders.

To choose a name for an establishment, you will need to indicate the main nuances of the chosen direction, the activities of competitors, and demand parameters.

Some individual entrepreneurs turn to specialists for help for a fee.

This is necessary for beauty salons, gyms and other similar establishments. If you plan to open a retail outlet located in a market area, there is no need to come up with an interesting name.

Right to use the name

Each subject of economic relations taking part in economic activity can register its own name.

List of subjects:

- Joint stock companies of any type - closed and open.

- Limited partnerships.

The constituent documentation of the individual entrepreneur must indicate the full name of the businessman without abbreviations. Personal information acts as a kind of name for the established company, since it is an official designation.

The chosen business name can be used by other individual entrepreneurs. If you want to have an individual name, then you need to register a trademark.

Procedure

To register the name of an individual entrepreneur, you will need to go through a special registration procedure.

Experts note that it is difficult for ordinary businessmen, so it is best to seek help from professionals in this field.

Thus, registration is impossible if the name:

- Completely or partially (70%) coincides with a mark already registered. To obtain information on this issue, it is enough to leave a request to Rospatent to verify the selected name. If it does not pass, then the reason is given in writing.

- If the chosen sign is likely to mislead buyers or clients. For example, a beauty salon cannot be called “Car Repair Shop”.

- The mark includes the full names of government bodies, services, inspections or their abbreviated names.

If the chosen company name for an individual entrepreneur does not conflict with the provisions listed above, then an application for registration of the mark is submitted.

Is it possible to assign a name to an individual entrepreneur? This question concerns most novice businessmen. On the one hand, the official name of the entrepreneur is the last name, first name and patronymic. On the other hand, they are not always sonorous and will look and sound appropriate in advertising. In fact, an entrepreneur is not prohibited from using a business name. But it is worth carefully understanding this issue.

Is it possible to assign a name to my individual entrepreneur, do I need to register it?

In accordance with the legislation in Russia, the official name of an individual entrepreneur is the combination of this abbreviation with the last name, first name and patronymic. No other word or combination can be used for this.

This is exactly how the abbreviation in combination with the full name of the entrepreneur is indicated in the register both during registration and in the process of activity. It is important to understand that an entrepreneur is exclusively an individual. Therefore, it is impossible to register a company name for an individual entrepreneur.

Naturally, in official documents, including on checks and invoices, only an individual entrepreneur has the right to indicate in combination with his last name, first name and patronymic. However, in order to gain individuality, a business owner can name a store or place of service in a unique way. This approach makes the object memorable and facilitates advertising.

It should be borne in mind that for individual entrepreneurs the name is not included in the registration documents. The name is used solely to identify the place of business. When organizing a network of business objects, an individual entrepreneur has the right to use one name to designate them.

If an entrepreneur subsequently wants to make his business unique, he has the right to register a trademark. It can be a logo or name.

Registering a trademark helps achieve the following goals:

- combine objects owned by a businessman (shops, hairdressers, etc.);

- stand out among competitors;

- build your own recognizable brand.

It turns out that the question of what to call an individual entrepreneur sounds incorrect. It is more correct for an entrepreneur to choose the name of a retail outlet or other facility in which the activity is carried out.

If an entrepreneur chooses non-proprietary designations for his objects, there are no strict requirements for them.

However, it is important to know a few rules that will help make the name memorable:

- It is important to achieve simplicity; the name should be easy to pronounce and write. This name will quickly be remembered and will be easily passed on from person to person. In the end, it will be clearly associated with a specific entrepreneur. Complex abbreviations and phrases cannot become a high-quality name.

- A name that is a generally accepted concept cannot be registered.

- Experts do not advise using too much descriptive information when naming a business.

- If an entrepreneur believes that he will not stop, and subsequently his activities will expand, it is not recommended to use a link to a specific geographical area or product in the name.

- It is also advised to refrain from using first and last names, words with ambiguous interpretation.

You should be careful when using foreign words. They should sound adequately in Russian. It is worth carefully studying the translation of the resulting name, possibly with the assistance of a specialist. Dual meaning can tarnish the reputation of a businessman.

It is important to keep in mind that other organizations have the right to use any name. Today, government agencies do not maintain a list of names. Therefore, there is no point in checking the presence of the selected name in the registry. However, you should always strive for uniqueness. This allows for business recognition and helps clients uniquely identify the company.

They say: whatever you name the ship, that’s how it will sail. The same can be said about a store opened by an individual entrepreneur. The name should be sonorous, memorable and understandable. But here the question arises, is it necessary to register the name of the store? This is not necessary.

But if an entrepreneur comes up with a truly unique name and wants it to belong only to him, he has the right to register a service mark. In this case, the commercial designation can be used by the copyright holder and no one else.

To register the name of an individual entrepreneur, you should contact Rospatent.

In this case, you must provide a package of documents:

- a receipt for payment of the appropriate fee;

- an application requesting to register a service mark, which must include information about the entrepreneur;

- the name to be registered is contained in the application itself and in the annex to it;

- a description of the service mark explaining it;

- a list of goods and services for which the registered name will be used.

Prepared documents can be sent to Rospatent by mail, brought in person or sent using electronic means of communication.

After the registration procedure is completed, the entrepreneur will be issued a certificate for the service mark. The right of exclusive use is valid for ten years; after its expiration, it can be extended an unlimited number of times.

If an individual entrepreneur wants to record the uniqueness of the company name he uses, he can register it. In this case, only a specific entrepreneur will be able to use the trademark name in his activities.

Before going through the registration procedure, you should familiarize yourself with a number of rules:

In addition to following the rules above, it is important to ensure that the trademark complies with legal requirements. They are reflected in the Civil Code of the Russian Federation.

The name or trademark chosen by an entrepreneur is not always unique. Experts advise first of all to contact Rospatent to check them. This will help avoid refusal of registration, which means it will save a lot of time.

You should know what circumstances may lead to the fact that a name or trademark will not be registered:

- the chosen name misleads potential customers;

- the name partially or fully coincides with one that has already been registered previously;

- the chosen name includes the designation of a government agency.

Only if all the above conditions are met, an individual entrepreneur can apply for registration. First of all, you will need to pay the state fee. It is one thousand rubles.

Some particularly enterprising citizens register a name. They can sell it later. Moreover, the cost of especially interesting specimens reaches tens of thousands and even more.

Do not forget that conducting business under an already registered name can lead to unpleasant consequences. The owner of such a trademark has the right to go to court. If the decision in the case is made in his favor, the entrepreneur will be fined.

By law, the name of an entrepreneur includes the last name, first name and patronymic. However, an individual entrepreneur has the right to register his own individual name. Do not forget that this procedure is regulated by law.

At the start of his activity, and sometimes even several months after its start, an entrepreneur is concerned with many questions, the answers to which, except for a lawyer, are often not available to anyone. One of them - ? More and more people are choosing this registration form today. But, knowing that individual entrepreneurs are often called by the owner’s last name, some begin to doubt the correctness of their choice.

Indeed, a store with a name like “IP Ivanov” will not look very attractive. But we don’t see such signs, with the exception of departments in department stores and points in markets. Does this mean that stores, salons and other small organizations are registered as LLCs?

Not at all. Checks will help us quickly verify this. Go, for example, to cooking. Perhaps somewhere on the wall, in a not too conspicuous place, you will see a message that this is the “ownership” of an individual entrepreneur, plus the name of the individual entrepreneur himself. This is usually written on a sheet of A4 paper attached to the file. But there’s a different name on the sign!

On the check issued you will certainly find the name in which the business is registered. But the name, which colorfully alerts passersby that a culinary establishment is located here, most likely will not be there at all.

Even in large grocery supermarkets, whose names are known throughout the country, you can sometimes find an inscription on the receipt stating that the owner is. Most likely, this store is open as a franchise. The trademark and name are registered, the network exists, and a single point is open as an individual entrepreneur.

How to name an individual entrepreneur and how to formalize this legally?

It turns out that it is possible to legally combine the two names? Then the main thing – the one that is created for clients – will be resonant and interesting. And what is necessary for registration will remain only in the documents. But how to do that?

There is no secret to this. According to the legislation that is currently in force in our country:

The name of the individual entrepreneur is the full name of the owner; in fact, it is not some kind of company, but a designation of a specific person - an individual entrepreneur;

The name that customers see on the sign may be different, and this is not prohibited by law.

Simply put, if you are already registered as a legal entity and are opening a grocery store, there is nothing wrong with decorating the entrance beautifully, hanging a sign and giving an appropriate name that will be displayed on it. At the same time, there will be no problems with legislation in the future. What is listed in the documents is the name of the individual entrepreneur, and what is publicly visible is the commercial designation.

It turns out that you can call your business a “middle name” for visitors at your discretion. What kind of name it will be is up to you to decide. And to the question “ Is it necessary to legally register the name of an individual entrepreneur?“, the answer is simple: for the second one, it’s not necessary.

What to call an individual entrepreneur. Is it necessary to legally formalize the name of an individual entrepreneur?

However, there are exceptions: some names you will not be able to use. If there is already a company in the same direction with a similar name, and you decide to borrow it, you will actually use their brand for your own purposes. Of course, this may not be noticed for many months or even years, especially if you have a different design, but one day the legal owners of the name may find out about your business and decide to sue for a tidy sum.

To avoid this, you should find out in advance whether you risk getting into such a situation with your invented commercial designation. Thinking what to call an individual entrepreneur, be prudent.

Please also note here: you are breaking the law only if you use the name of a registered brand, trademark. If, for example, you have a flower shop “Romashka”, and on the other end of the city there is a similar one, but it is also just an individual entrepreneur, the situation is different. Do competitors with the same name have the same fictitious name and not listed in the papers as yours? Then you are not breaking anything.

If you want no one to use the selected name, you need to go through the procedure.